Gold remains a safe haven amongst market volatility

By Josh Butler

Turmoil in the Middle East leads to rush in investors

Samar Abu Elouf / The body of a child was recovered from under the rubble of the Soussi Mosque, which was bombed by Israeli warplanes in the Shati refugee camp

Gold prices have been rising in recent weeks, driven by a combination of factors, but most urgent being rising geopolitical tensions in the Middle East, caused by the eruption of conflict between Israel and Hamas. This has raised concerns about a wider regional war, and investors are turning to gold as a safe haven asset.

Other factors that have driven a rise in gold, include:

- Weakening US dollar: The US dollar has been weakening against other major currencies, which makes gold more attractive to buyers outside the United States.

- Central bank buying: Central banks around the world are continuing to buy gold, diversifying their reserves and protecting against inflation.

- Investor interest: Institutional investors are increasing their exposure to gold as a way to hedge their portfolios against market volatility.

We will explore some of these factors further now.

Gold prices set to break longest losing streak in 7 years

Anne Nygård / Despite facing it’s longest losing streak in seven years, Gold is still up over 10% year-to-date

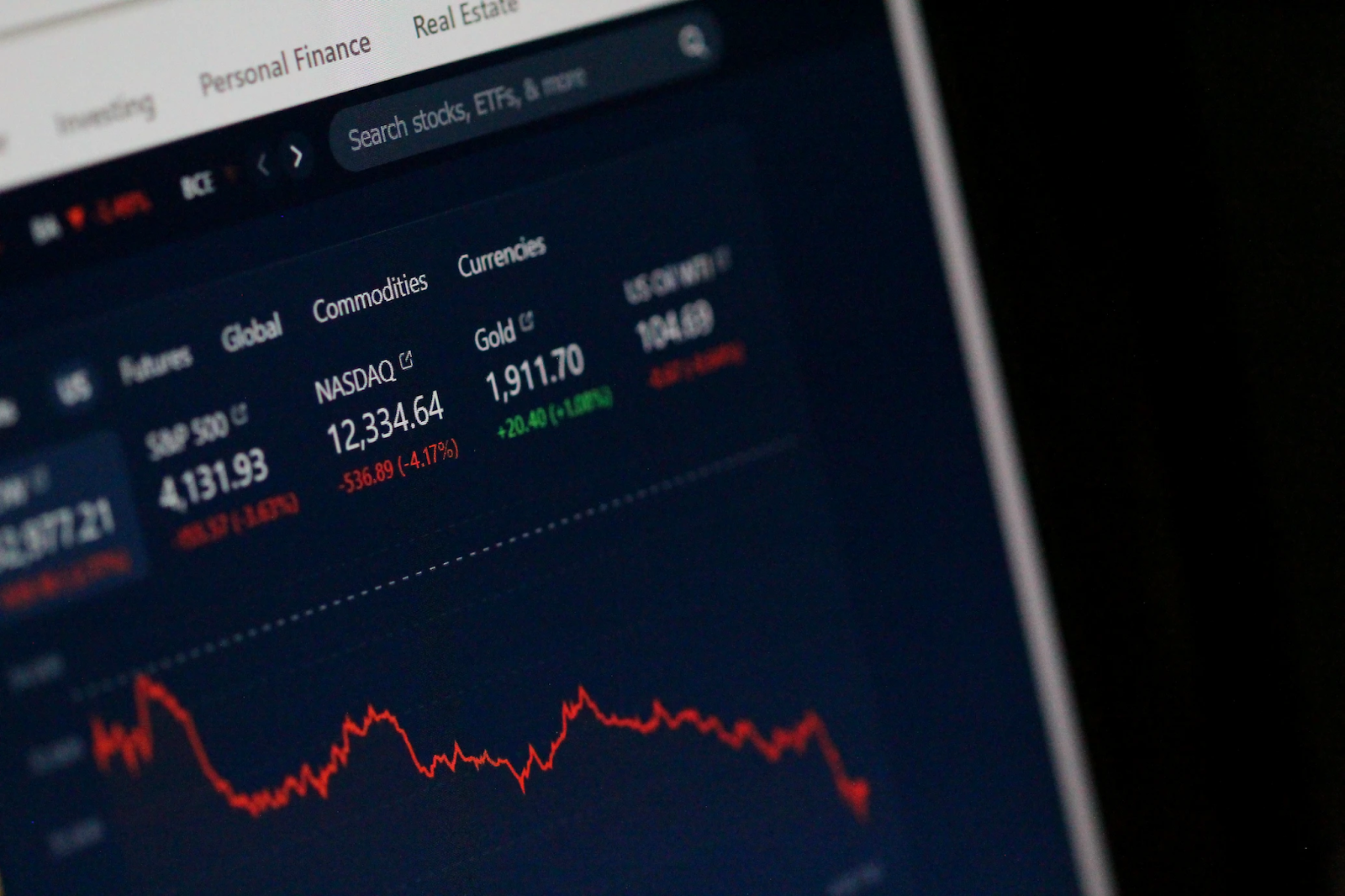

Gold prices are on track to break their longest losing streak in seven years, as a recent selloff in bonds cools.

Gold is often seen as a hedge against inflation, and investors have been buying gold as bond yields rise. However, the recent selloff in bonds has eased some of the concerns about inflation, and investors have been taking profits on their gold holdings.

Despite the recent pullback, gold prices are still up over 10% year-to-date. And analysts say that the long-term outlook for gold is bullish, given the rising geopolitical tensions and the ongoing central bank buying.

Russia’s Finance Ministry target gold with their fiscal plan

Tellerreport / The Russian Finance Ministry

Russia’s Finance Ministry has announced that it will allocate 18.12 billion rubles per day to purchase currency and gold under its fiscal rule.

The fiscal rule is a set of rules that the Russian government uses to manage its budget. The rule includes a provision that requires the government to purchase currency and gold when oil prices are above a certain level.

The Russian government’s decision to increase its gold purchases is seen as a sign of its confidence in the precious metal. It also comes at a time when the Russian economy is facing significant sanctions from the West.

Brevan Howard Plans $750 Million Push Into Commodities Trading

Jason Alden / Brevan Howard Asset Management LP offices in London

Hedge fund manager Brevan Howard is reportedly planning to launch a $750 million fund to invest in commodities, including gold.

The fund would be Brevan Howard’s first dedicated commodities fund. The firm already has a significant exposure to commodities through its other funds, but the new fund would allow it to focus specifically on this asset class.

The launch of the new fund is a sign of the growing interest in commodities from institutional investors. Commodities are seen as a way to hedge against inflation and market volatility.

Gold Glitters In China’s Financial Storm

Forbes / Gold vs The Chinese Yuan

Gold is glittering in China’s financial storm, as investors turn to the precious metal as a safe haven asset.

The Chinese stock market has been falling sharply in recent months, and the Chinese yuan has also weakened against the US dollar. This has led to a surge in demand for gold from Chinese investors.

Gold is seen as a hedge against inflation and economic uncertainty. It is also seen as a way to diversify investment portfolios in a country that is experiencing unusual volatility, with usual investment targets like construction sector and technology faltering in recent years.

The Chinese government is also supportive of the gold market. The government has been taking steps to promote the use of gold in China, and it has also been increasing its own gold reserves.

Headlines you should take from all this

The recent rise in gold prices is a reflection of the growing demand for gold from investors around the world. Investors are turning to gold as a safe haven asset amid rising geopolitical tensions, a weakening US dollar, and ongoing central bank buying.

Institutional investors are also increasing their exposure to gold as a way to hedge their portfolios against market volatility.

The long-term outlook for gold is bullish, given the rising geopolitical tensions and the ongoing central bank buying.

Things to keep in mind when making the most of Gold’s rising value

If you are looking to make the most of gold’s rising tides, there are some things you should always keep in mind.

- Risk tolerance: Gold is a volatile asset, and its price can fluctuate significantly. Investors should carefully consider their risk tolerance before investing in gold.

- Investment horizon: Gold is a long-term investment. Investors should be prepared to hold their gold investments for a period of at least five years.

- Investment objectives: Investors should consider their investment objectives before investing in gold. Gold can be used as a hedge against inflation, a safe-haven asset, or a portfolio diversifier.

Best ways to invest in Gold

There are a number of ways to invest in gold, including:

- Physical gold: Investors can buy physical gold in the form of coins, bars, or jewelry. Physical gold can be stored at home or in a safe deposit box.

- We here at London Gold Xchange supply a great range of Gold Bullion, Silver Bullion and collectible Gold coins which are all highly sought after, and provide a great investment opportunity. If you want to have a diverse portfolio, owning physical gold is a great way of doing this.

- Gold ETFs: Gold ETFs are exchange-traded funds that track the price of gold. Gold ETFs are a convenient way to invest in gold without having to buy and store physical gold.

- Gold mining stocks: Investors can also invest in gold by buying shares of gold mining companies. Gold mining stocks are a more volatile way to invest in gold, but they also have the potential for higher returns.

Recent articles

Gold Coins that celebrate the Tudor dynasty

All creatures great and small: Golden depictions of animals

Kyle Bass: The prophet of Wall Street doom and leading Gold investor