Investing in Gold Bars and Coins: A Smart Choice for New Investors

When looking to invest, new investors are bombarded with options ranging from stocks and bonds to real estate and cryptocurrencies. Among these myriad choices, gold stands out as a timeless and stable investment. Once you have settled on gold as part of your portfolio, the next question arises: what form should your gold investment take? We suggest bullion and coins as the best place to start. Here, we delve into the three main advantages of investing in gold bars and coins.

Gold Bars and Coins are Tangible

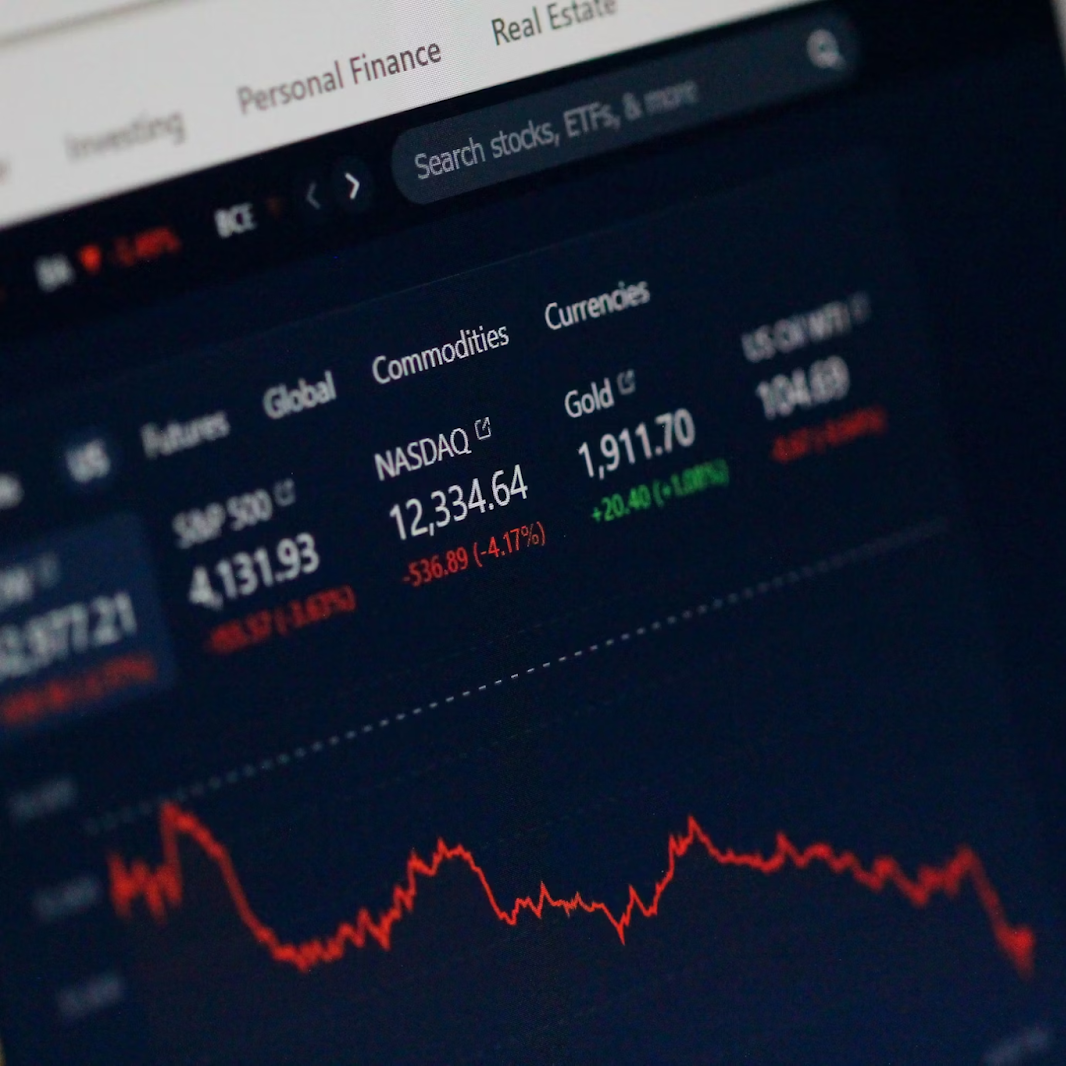

One of the most compelling reasons to invest in gold bars and coins is their tangibility. Unlike derivative investments such as ETFs and mutual funds, which are essentially paper assets, gold bars and coins are physical assets that you can hold in your hand. This tangibility can provide a sense of security and assurance that your investment is real and not merely a speculative instrument. In a world where financial markets can be volatile and unpredictable, having physical gold can be a valuable counterbalance.

Physical gold is immune to the risks associated with electronic and paper-based assets, such as cyber-attacks, fraud, and technical glitches. Additionally, gold does not carry counterparty risk; its value is not dependent on the performance or solvency of any entity, unlike bonds or stocks, which can be significantly impacted by the issuing company's or government's financial health. This intrinsic value of gold, combined with its long history as a reliable store of wealth, makes it an attractive option for conservative investors.

Moreover, the physical presence of gold bars and coins means they can be stored and protected according to the investor's preferences, whether in a home safe, a bank safety deposit box, or a professional vault. This control over the physical security of the asset is a crucial advantage, offering peace of mind that one's wealth is safeguarded against unforeseen economic disruptions or institutional failure

Easy to Buy

Purchasing gold stocks, ETFs, or mutual funds often requires opening a brokerage account or buying shares directly from the fund itself, which can be a daunting task for those unfamiliar with the process. In contrast, buying physical gold bars and coins is a straightforward process. At London Gold Xchange, we specialize in helping people secure their financial future with physical gold. We provide guidance and support, making it easy for anyone to buy gold and take the first step toward diversifying their investment portfolio.

In the USA, you can even purchase gold bullion at stores such as Walmart

To begin, you can visit a reputable dealer like London Gold Xchange, where experts are available to guide you through every step. Whether you're looking to purchase online or in-person, the process is user-friendly and transparent. Online platforms typically offer a variety of gold bars and coins, complete with detailed descriptions and prices, making it easy to compare and select the right product for your needs.

Moreover, many gold dealers provide educational resources and customer support to help you understand the intricacies of investing in gold. You don't need extensive knowledge about the market or complex trading platforms; the emphasis is on making the process as simple and accessible as possible.

Gold Bars and Coins are Highly Liquid

Liquidity is a crucial factor to consider with any investment, as it measures the ease with which an asset can be converted into cash without significantly affecting its market price. Gold bars and coins are renowned for their high liquidity, making them an ideal investment for those seeking flexibility and security.

When you invest in assets like real estate or certain collectibles, selling them quickly can be challenging. These assets often require lengthy selling processes, involve significant transaction costs, and may not attract buyers immediately. In contrast, gold bars and coins are globally recognized and universally valued, ensuring a broad and active market for these precious metals. This means you can sell gold easily and quickly, often at or near market prices, providing immediate access to cash when you need it most.

The liquidity of gold bars and coins is further enhanced by the presence of numerous dealers and institutions willing to buy them. Whether you choose to sell through online platforms, local gold dealers, or even pawnshops, you can be confident in finding a buyer. This widespread demand ensures competitive pricing and minimizes the risk of significant losses due to market fluctuations.

Additionally, the liquidity of gold bars and coins is not confined to a single geographic location. They can be sold virtually anywhere in the world, making them an excellent option for investors who might need to relocate or manage their assets across different countries. This global liquidity provides a level of financial security and versatility that many other investments lack.

Investing in gold bars and coins offers new investors a tangible, easily accessible, and highly liquid way to diversify their portfolios. The physical nature of gold provides a sense of security, the simplicity of the buying process makes it accessible, and its high liquidity ensures that you can convert your investment into cash when needed. At London Gold Xchange, we are committed to helping you navigate the process of buying physical gold and securing your financial future. Consider adding gold bars and coins to your investment portfolio today and experience the benefits of owning a timeless and valuable asset.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.